Research Objectives:

This study explores financial wellness challenges in the music, entertainment, and sports industries, highlighting key factors contributing to financial instability among artists and athletes.

Keywords:

Financial Literacy, Lifestyle Inflation, Irregular Income, Investment Strategies, Financial Planning.

Bio

Michelle Richburg, President and CEO of Richburg Enterprises, sees financial management as more than just statistics and figures; it is a means to positively impact her clients’ lives and legacies. Her personalised approach has made her a leader in her field, recognised as one of Billboard’s “Top Business Managers” from 2020 to 2023 and featured on the “R&B/Hip-Hop Power Players” list. In 2021, The Recording Academy invited her to join as a member, and she was honoured in Billboard’s 2023 Women in Music. In 2024, she received The Buddy White Project Community Service Award and numerous City, State, and County Citations. As a trusted advisor, she represents multi-platinum superstars and is the accounting firm for the WMG BFF Social Justice Fund.

Abstract

This study explores financial wellness challenges in the music, entertainment, and sports industries, highlighting key factors contributing to financial instability among artists and athletes. Many individuals in these fields lack financial education, stemming from backgrounds where personal finance is not prioritised. Without early exposure to financial literacy, poor decision-making often follows the acquisition of wealth, with financial advisors typically consulted after problems arise. Additionally, a culture of overspending and lifestyle inflation exacerbates the situation, as celebrities frequently buy expensive items to maintain appearances, unaware of their limited career longevity.

Irregular income patterns and short career spans further complicate financial stability, as earnings peak early, leaving little time to secure long-term savings. Many celebrities also feel obligated to support large entourages, draining their resources. Poor investment choices, scams, and tax mismanagement often lead to financial ruin due to a lack of financial acumen. Mental health struggles, fuelled by the pressures of fame, contribute to impulsive spending and financial stress.

To promote financial wellness, solutions include early financial education, hiring reputable financial advisors, setting budgets, and establishing boundaries with dependents. Long-term financial planning and investment strategies that consider irregular income and short career spans are essential for fostering sustainable wealth in these high-pressure industries.

-

Introduction

Artists and athletes within the professional sports and entertainment industries often possess enormous income potential; however, they may also face unique financial and related challenges as they navigate their careers. Financial literacy, or the ability to understand and manage one’s financial resources effectively, may thus play an integral role in the survival and success of these artists and athletes (Bialowolski et al.2022). In spite of the growing dialogue about sports and entertainment within academic and industry contexts, there has been little substantial research about the intersection of sports, entertainment, and finance. Only a small number of first-person accounts and anecdotal commentaries exist that address the important challenges of financial wellness in the music, entertainment, and sports industry. Moreover, there may be important differences in regard to how challenges related to financial well-being play out for individuals who work as creative performers within these highly competitive and creative fields of work (Dingle et al.2021).

The purpose of this research paper is to shed light on the financial rollercoaster experienced by individuals in the music, sports, and entertainment industries. It will explore the erratic nature of their earnings, which often leads to financial instability, and underscore the critical need for a structured wealth blueprint. By emphasising the importance of working with financial experts specialised in entertainment, this paper aims to advocate for a strategic financial roadmap that can ensure long-term financial security and stability, helping artists and athletes navigate their careers and post-career financial futures more effectively.

The prevailing model for most of the last century or so, and the one still followed by most music, entertainment, and sports organizations today, has relied on a talent and management agency framework, whereby the agency or company serves as a de facto employee or contractor for the performer or athlete (Runstedtler, 2023). These companies manage the money on behalf of their talent and have made decisions on behalf of the talent about the work in which they and their company will engage. Because entertainment and sports companies have always acted as the financial intermediaries in the careers of the talent they employ, many artists and athletes developed an attitude of “I’ll let my manager/agent/business manager worry about the money stuff.” Over time, of course, the negative consequences of such an approach became evident. A large percentage of artists and athletes have been notoriously undisciplined about saving even the most massive amounts of money they earn. As the hundreds of artist and athlete bankruptcies during the late 1970s and mid-80s indicate, financial instability can occur in and of itself as a result of the free-enterprise structure alone and has little to do with the up-and-down failure of a life in entertainment or sports.

-

Challenges Faced by Artists and Athletes

Many artists and athletes face myriad strikes to their financial wellness. A lack of financial education coupled with lopsided direct access to income has affected the industry at large. It is often drilled into entertainers that living beneath their means indicates failure and could ultimately ruin their careers. Many artists and athletes have irregular income and lack the cushion of savings to respond to financial emergencies. The industry also has a high level of risk associated with it, as artists and teams can be successful and in demand one day and irrelevant the next (Greer, 2021). Additionally, artists and athletes have a limited window of opportunity to capitalize on their individual careers, forcing them to optimise their earning potential during the prime of their lives. The methods artists and athletes often use to improve their mood or outlook, such as retail therapy, vacationing, or overspending, are very telling as well. In many cases, these same people are seeking to manage their employees’ spending habits by limiting direct access to cash. Although it is very common in the industry, the inability to handle finances is just as deep-rooted as some of the personal issues these creatives endure. Overspending has been a leading issue in the industry for years but is often seen as incidental for those without fiscal pet peeves. Typically, poor financial habits or subpar education will lead to overspending, but the culture surrounding the industry would likely encourage it. However, when the symptoms are normalized, the root cause remains unchanged. This is partly why the topic of finances should be approached much differently than it currently is.

Figure 1 illustrates four reasons why athletes and entertainers need a financial plan according to Richburg Enterprises LLC.

Figure 1 (Richburg, 2024)

2.1. Lack of Financial Education

In order for artists and athletes to achieve financial wellness, they must have the knowledge necessary to make informed decisions about their income. However, many have little or no background in financial management, a concern that is to be addressed through the development of a financial wellness strategy (Radbourne, 2023). The analysis demonstrated the challenges that affluent or high-income individuals face due to their lack of advanced financial education. This makes them vulnerable to financial mistakes like weak investments, fraud, and numerous other pitfalls. Being educated on financial fundamentals will not eliminate this issue, but it can help these individuals first understand the information and then strategize the management of their assets and finances.

Across the music, entertainment, and sports industries, very few individuals receive any formal financial education. The music industry, in particular, finds itself in a deleterious position; while individuals in the entertainment industry typically begin their careers in what is known as the “indie ecosystem,” where they are solely responsible for managing their lawyers and business operations, most of these individuals have no professional training in music business administration. On average, it takes a musician ten years to receive a formal, professional introduction to the music business. Current composers, choreographers, and scriptwriters enter the U.S. talent market without the business skills to budget appropriately at least 61% of the time (Rascher et al.2021). Football and men’s basketball at the NCAA Division I, II, and III levels reported that some type of financial education program occurred between the 2017 and 2018 fiscal years. In the NBA, rookies are required to attend a series of presentations on “life skills” and “financial management” in the summer of their first year.

2.2. Pressure to ‘Keep Up with Appearances’

Social constructs for societal expectations of gender include that men do not need help or should be the caretakers of the family, have hidden needs, or fail when striving to meet expectations. These underlying attitudes often influence societal messages, which result in individuals who desire support questioning prior to seeking help. Some of these societal pressures can manifest as difficulty in managing one’s personal finances and build in ‘keeping up with appearances’. Not only does this apply pressure to live outside of a person’s financial means, but others, especially those who do not understand the struggles of this industry, misinterpret what they perceive as lavish and luxurious lifestyles (Tupacyupanqui, 2023). In general, those who work in the music, entertainment, and sports industries all face consistent pressures to create high-status displays. It makes sense if you have an above-average income, but what happens if you don’t? What if you have to face months, if not years, of unemployment? It should come as no surprise that many entertainers and athletes have a tendency to overspend.

When on average each new movie, sports, or music release generates significant revenues, the idea that an actress, athlete, or musician makes a reasonable sum is not far-fetched. You can take home a substantial amount each year and draw combined billions in sales. However, a look at a larger sample size demonstrates that the majority of people operating in film, sports, or music industries generate well below the millions—most generate nothing (Hardie et al., 2022). This can lead to a hyperawareness of needing to spend more to maintain status. The psychological effects of stresses such as these can be undeniable. A study reflecting the financial anxiety of professional athletes shows that the stress comes from a combination of their having spent an immense amount to sustain their high-status display and that they have the ability to lose it. A survey indicated that more than 40% of professional athletes expressed worries about losing their status. The superstars have developed some coping strategies, but that feeling exists.

Many professional athletes are not poor to begin with. In fact, we live day by day when it comes to breaking down the annual wage in international philanthropy. This leads to a subset of individuals who don’t know what to do with massive lump sums when they get them. What is missed in financial literacy when concentrated on personal financial strategies is the circumstances that may lead an individual to overspend. After engaging in an interview with a professional musician, a significant amount for two weeks of a touring artist in the city is not out of the ordinary (Orunbayev2023). This, in turn, can cultivate and showcase some of those financially damaging behaviors mentioned above. The words of one rapper help paint a juxtaposed picture: “I’m trying to get the outside of me to be as rich as the inside of me.” However, the problem here that has been discussed is that this income is short-term (a career in sports lasts for a period of income, as does artistry, which also has the added bonus of being at the whim of an audience). Major league sports have players who can make near to the reported average monthly income for the entire year, amounting to what the individual cannot hope to continue if they no longer operate. Irregular income patterns are common among artists, athletes, and many in the entertainment and sports industries.

A short career length and career termination through injury are common among professional athletes. One of the overwhelming 64% of professional athletes who leave sports because of injury that required surgery discussed that between the time he called for information and the time he traveled to negotiate his release with management at the sports team he had been playing with, he was scrambling to adjust to the reality of dealing with the physical and emotional ramifications of his injuries, as well as desperately culling through a mountain of healthcare bills and insurance paperwork (Hong & Fraser, 2021). Most Americans know how to handle money when we are paid regularly. But with artists, athletes, and many other individuals whose earnings come in fits and starts or do not occur with predictable regularity, opportunities for saving and investing money on a consistent basis are exceedingly rare. Cumulative economic shock from the cold winds of uncertainty results in greater psychic loss.

-

Contributing Factors to Financial Instability

In an era that has seen a striking decline in financial wellness across the spectrum of identity and activity, the artists and athletes who depend on the labels, teams, and tech platforms to advance their careers are especially vulnerable. In a time when financial advice is geopolitical, access to financial literacy has become largely privatised and commodified. While more young adults than ever have savings accounts, more than two-thirds report having experienced a sharp drop in income due to a layoff, canceled contract, or other income reduction (Erin et al.2024). Indeed, over half of adults cannot afford a $400 emergency expense. The vulnerabilities contributing to such widespread financial instability rarely stem from one single occurrence; rather, they are accumulations of vulnerabilities that make an unexpected expense, debt, or loss of income wholly untenable.

One of the most common indicators of financial instability among artists and athletes is large overdraft and/or credit card debt, tax mismanagement, and poor investment decisions (Greene & Stavins, 2023). In a moment when trading apps make performance a normal aspect of financial investment, stock trading has become increasingly accessible and appealing as an investment option.

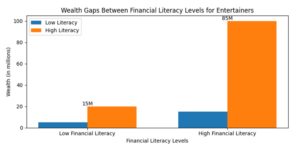

Figure 2 highlights the wealth gaps between financial literacy levels for entertainers, measured by wealth in millions.

Figure 2 (Richburg, 2024)

3.1. Poor Investment Choices

Poor investment choices are a major cause of financial instability for artists and athletes, often resulting from inadequate understanding of financial risks. Despite having sufficient wealth, many invest in ventures that seem lucrative without fully researching potential pitfalls. Celebrities can be swayed by popular trends, media pressure, or advice from agents who may not have their best interests at heart (Bradbury et al.2023). Additionally, athletes facing career uncertainty often rush into investments to secure their financial future. To avoid significant losses, entertainers and athletes need to be better educated about investments and rely on trustworthy advisors who carefully evaluate opportunities.

3.2. Tax Mismanagement

Misunderstanding tax obligations can have serious implications for artists and athletes, especially when income comes from multiple international sources. Ignorance is not a defense, and tax advisers must educate clients on proper tax planning, including inheritance and international tax considerations (Cowling et al.2020). Many stars prefer to draw income as dividends from their companies rather than pay income tax and National Insurance regularly, which can lead to cash flow issues and financial strain. Poor tax planning increases the risk of bankruptcy and penalties. To avoid this, responsible financial management, including keeping a savings reserve and proper tax planning, is crucial for financial health (Onjewu et al.2024).

3.3. Mental Health Challenges

Individuals in creative industries, such as music, entertainment, and sports, often face heightened stress, anxiety, and depression, which, combined with a lack of financial literacy, impairs their ability to make sound financial decisions (Greenwell et al., 2024). Mental health struggles, such as depression and impulsivity, can lead to destructive financial behaviors, including lavish spending in response to emotional pain. This problem is worsened by the avoidance of professional help due to fear of negative reputations, further eroding financial stability. To address this, it is crucial to promote financial knowledge alongside mental health interventions, helping individuals manage stress and make better financial decisions for long-term stability (Morse et al., 2021).

-

Strategies for Financial Wellness

Strategies to attain financial wellness 1. Achieve financial literacy. 2. Hire a financial advisor who understands the unique circumstances of the people in the music industry, entertainment, or sports; knows that the median length of a career in these industries is very short, and annual income is likely to be highly volatile; knows the costs of coaching, trainers, travel, and other expenses related to getting and maintaining a job; knows the reputation of scouts and hiring managers and can give viable advice; not just a money manager, tax preparer, or college planner; they can be on retainer if you have the resources to choose a person who is helpful to you; a free one-time look at a financial plan if resources are fewer. 3. Establish a workable budget right now from this moment forward because years go by, often with little work, and we need to know how to spend and preserve the dollars earned while working. 4. For greater net worth and financial security, after expenses and savings, start paying off all loans with no interest. Open an individual retirement account if you can. It can be a contribution to your financial stability—an emergency account. 5. Ongoing education and support for your entire financial future; identify, rally together, and attain financial resiliency; we work for the entertainment, music, and sports industries—live your best financial life; plan for your reputation, support your financial resilience, lifetime financial wellness, and success to navigate the industry (Fana et al.2020).

4.1. Promoting Financial Literacy

Many artists and athletes face financial vulnerability not due to a lack of income, but a lack of financial management skills. To address this, organizations are offering tools and resources to help individuals, especially newcomers, develop good financial habits early in their careers. While access to financial management tools is important, knowledge is crucial (Cohen & Ginsborg, 2021). Financial literacy workshops, seminars, and online resources tailored to the unique needs of artists and athletes are key to improving financial wellness. Specialized education programs, eLearning platforms, and periodic updates for managers and advisers can foster a culture of informed financial decision-making.

4.2. Hiring Competent Advisors

Managing finances in the music, entertainment, and sports (ME&S) industry requires both financial expertise and industry knowledge. To secure one’s financial future, hiring competent and trustworthy advisors is paramount (Musa & Ibrahim, 2022). With the complexity of tax laws and financial regulations, even those knowledgeable in finance often need professional help. When selecting an advisor, experience, credentials, and a proven track record of increasing wealth are essential. Advisors should offer full transparency, collaboration, and a focus on more than just investments—budgeting and money management are equally important (Hildebrand & Bergner, 2021). Ultimately, building trust with an ethical, qualified advisor is key to long-term financial success.

4.3. Setting Budgets

An artist, athlete, or entertainment industry professional would set a budget to achieve financial wellness. In setting a budget, the irregular nature of artist, athlete, and entertainment professional income must always be kept in mind. This should entail creating a budget that is strict enough to ensure sustainability if an income drop occurs, yet flexible enough to adjust should the artist, athlete, or professional income take a sudden jump. Money raised in entertainment, advertising, and sports salaries comes sporadically because it can change radically as a result of unforeseen circumstances.

1) Cash Flow Statement: A budget starts by figuring out how much money you’ve spent over the past three months. This amount is calculated by adding up all the money spent over the last three months and then dividing it by three. This average is then earmarked as the monthly budget (Prabhu et al.2023). 2) Prioritising: Get an idea of your monthly obligations and needs. Here’s a list of what comprises basic needs in a budget: * Housing * Food * Transportation * Health Insurance * Property, Gas, Electric, etc. 3) Savings: Pay yourself first. A percentage of your monthly budget amount should be set aside as a savings fund for future things like a new car, a deposit on a house, a vacation, or a rainy day. Depending on the artist’s personal aims and objectives, savings may also be retained for specific purposes: * Retirement * Purchases * Future Education * Health Costs * Wedding.

4.4. Developing Long-Term Plans

Planning for the long term is an important part of planning. It helps you stay focused on what is really important as you make day-to-day decisions. For most athletes and musicians, their playing or singing careers will be relatively short. Opportunities to maximise earnings are limited (Cohen & Ginsborg, 2021). That is why you need long-term plans to guide these key decisions. You often hear sound financial planning described as goal setting. This is because you need to know what you are working toward before you make any investment or savings decisions. While there are many possible goals, think especially about these less-obvious ones:

Emergency fund: It’s wise to have an emergency fund covering three to six months of living expenses in an accessible savings account. Plan for big expenses by considering your short and long-term goals, such as education, healthcare, and family needs. For retirement, save 5-15% of your income, adjusting based on your age and goals, to ensure sufficient funds when you’re no longer working (Gollier, 2020). Additionally, invest conservatively in assets like bonds or real estate to preserve wealth and protect against unexpected events. Regularly reviewing your financial plan with a professional, even early in your career, can help secure your future financial stability.

Maintain a Long-Term Perspective: Athletes and musicians have relatively brief and changeable careers. You may suddenly receive a large sum of money that must last you for a very long time—possibly the rest of your life. This may seem hard to contemplate, much less to plan for. To do so calls for great discipline. But you have the best chance of making what you earn last a lifetime if you plan prudently.

-

Conclusion

In summary, this research paper discussed the issue of financial wellness in the music, entertainment, and sports industries. Safe to say, their job is a unique piece of asset that can lead to unimaginable wealth, but it can also untimely develop into monetary failures. This can be produced by some factors, such as young age, insufficient amount of schooling concerning private finance, buoyant financial habits, and high expectations. Profits from techniques for promoting financial wellness are probably not to be accumulated quickly; nevertheless, commendation and education for a sound profile of employment can comprise a crucial primary stage. More study is necessary to progress and verify an effectual in-school and out-of-school involvement to endorse financial wellness among rising artists and athletes. Artists and athletes inhabit an atmosphere marked by swiftness, uncertainty, and a need for resilience. Even though ever-developing technology is creating new chances for admirers’ financial activity, one can only believe that numerous new investment alternatives characterised by quality and huge returns will increase the risk of financial irregularity and distress. The innovative environment can yet hardly modify the heritage risk side of turning into an artist or a sportsman, including optimistic and economically young, occasionally wounded, unseasoned ability trying out new day jobs in one of the world’s most cutthroat and flooded sectors, which perpetually storms them with hauls and appeals. Age may play a crucial role in one particular virtue of aquatic attendees’ financial knowledge: the financial adventure, discussed before.

References:

Bialowolski, P., Cwynar, A., & Weziak-Bialowolska, D. (2022). The role of financial literacy for financial resilience in middle-age and older adulthood. International Journal of Bank Marketing, 40(7), 1718-1748.

Bradbury, J. C., Coates, D., & Humphreys, B. R. (2023). The impact of professional sports franchises and venues on local economies: A comprehensive survey. Journal of Economic Surveys, 37(4), 1389-1431.

Cohen, S., & Ginsborg, J. (2021). The experiences of mid-career and seasoned orchestral musicians in the UK during the first COVID-19 lockdown. Frontiers in Psychology.

Cowling, M., Brown, R., & Rocha, A. (2020). Did you save some cash for a rainy COVID-19 day? The crisis and SMEs. International Small Business Journal, 38(7), 593-604.

Dalvand, H., Maleki, M. H., Jahangirnia, H., & Safa, M. (2023). Identifying and prioritizing investment risks in sports projects. Advances in Mathematical Finance and Applications, 8(1), 75-94.

Dingle, G. A., Sharman, L. S., Bauer, Z., Beckman, E., Broughton, M., Bunzli, E., … & Wright, O. R. L. (2021). How do music activities affect health and well-being? A scoping review of studies examining psychosocial mechanisms. Frontiers in Psychology, 12, 713818.

Erin Duffy, B., Ononye, A., & Sawey, M. (2024). The politics of vulnerability in the influencer economy. European Journal of Cultural Studies, 27(3), 352-370.

Fana, M., Torrejón Pérez, S., & Fernández-Macías, E. (2020). Employment impact of COVID-19 crisis: From short term effects to long-term prospects. Journal of Industrial and Business Economics, 47(3), 391-410.

Gollier, C. (2020). Cost–benefit analysis of age-specific deconfinement strategies. Journal of Public Economic Theory.

Greer, S. (2021). Funding resilience: Market rationalism and the UK’s “mixed economy” for the arts. Cultural Trends.

Greene, C., & Stavins, J. (2023). Credit card debt puzzle: Liquid assets to pay household bills. International Review of Economics.

Hardie, A., Oshiro, K. F., & Dixon, M. A. (2022). Understanding body image perceptions of former female athletes: A qualitative analysis. Body Image.

Hildebrand, C., & Bergner, A. (2021). Conversational robo advisors as surrogates of trust: Onboarding experience, firm perception, and consumer financial decision making. Journal of the Academy of Marketing Science.

Hong, H. J., & Fraser, I. (2021). ‘My sport won’t pay the bills forever’: High-performance athletes’ need for financial literacy and self-management. Journal of Risk and Financial Management.

Marian, O. (2022). The inequitable taxation of low-and mid-income performing artists. UCLA Entertainment Law Review.

Morse, K. F., Fine, P. A., & Friedlander, K. J. (2021). Creativity and leisure during COVID-19: Examining the relationship between leisure activities, motivations, and psychological well-being. Frontiers in Psychology.

Musa, S. J., & Ibrahim, K. M. (2022). Moderating role of board expertise on the effect of working capital management on profitability of food and beverages companies quoted in Nigeria. Journal of Positive School Psychology.

Onjewu, A. K. E., Nyuur, R. B., Paul, S., & Wang, Y. (2024). Strategy creation behavior and “last gasp” digitalization as predictors of sales performance and cash flow. International Journal of Entrepreneurial Behavior & Research, 30(2/3), 800-827.

Orunbayev, A. (2023). Globalization and the sports industry. American Journal of Social Sciences and Humanity Research, 3(11), 164-182.

Prabhu, A., Al Kader Hammoud, H. A., Dokania, P. K., Torr, P. H., Lim, S. N., Ghanem, B., & Bibi, A. (2023). Computationally budgeted continual learning: What does matter? In Proceedings of the IEEE/CVF Conference on Computer Vision and Pattern Recognition (pp. 3698-3707).

Radbourne, J. (2023). Arts management: A practical guide.

Rascher, D. A., Maxcy, J. G., & Schwarz, A. (2021). The unique economic aspects of sports. Journal of Global Sport Management, 6(1), 111-138.

Richburg, M. (2024) www. richburgenterprisesllc.com

Runstedtler, T. (2023). Black ball: Kareem Abdul-Jabbar, Spencer Haywood, and the generation that saved the soul of the NBA.

Tupacyupanqui, L. I. (2023). Why most pro-athletes go broke soon after retirement: A methodological investigation of the causative factors and solutions.