Research Objectives:

This research paper explores the importance of incorporating financial education initiatives into re-entry programs to support individuals transitioning back into society.

Keywords:

Education, Financial Education, Sustainability, Prisoner Re-entry, Prison Programs

Bio

Dr Lorie A. L. Nicholas, CFEI, AFC, is a distinguished professional with a robust background in counselling, teaching, and research. With a doctorate in Clinical Psychology, she has presented at numerous conferences and led a variety of workshops and trainings. Dr. Nicholas is also a Certified Financial Education Instructor and an Accredited Financial Counsellor, blending her expertise in psychology and finance to empower individuals with knowledge and skills for better mental and financial well-being. Her diverse experiences and qualifications make her a valuable resource in both academic and practical settings.

Abstract

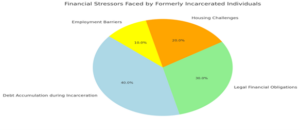

Sustainability and resilience have become critical concepts in addressing the complex challenges of a rapidly changing world, particularly in the context of prisoner re-entry programs. This research paper explores the importance of incorporating financial education initiatives into re-entry programs to support individuals transitioning back into society. Each year, over 600,000 individuals are released from state and federal prisons, with more than two-thirds rearrested within 3 years. Formerly incarcerated individuals often face unique financial stressors upon re-entry, including debt that has accumulated during incarceration, legal financial obligations, and challenges in obtaining housing and employment.

By providing financial education, individuals can develop the knowledge and skills to make informed decisions, access needed resources and maintain long-term financial well-being. Re-entry programs that incorporate sustainability and resilience financial frameworks can better prepare these individuals to navigate economic uncertainties and build financial stability. This holistic approach not only benefits formerly incarcerated individuals by reducing financial stress and improving overall well-being, but also contributes to broader societal resilience and sustainable economic development.

Coordinated efforts between public and private sectors in developing and implementing such programs are critical to maximising their impact and creating more resilient communities. By addressing the unique needs of formerly incarcerated individuals in the context of financial resilience and sustainability, these programs can potentially reduce recidivism rates and promote successful reintegration. This approach aligns with broader sustainability goals and contributes to building a more inclusive and resilient society.

-

Introduction

In the United States, more than 600,000 individuals are released from federal and state prisons each year. One of the possible entry barriers facing these individuals when reintegrating into society is a lack of financial literacy (Williams, 2022). Financial literacy is crucial in helping individuals to navigate managing the economic uncertainties that they will face upon initial release such as obtaining sufficient employment to cover living expenses and handling employment changes, such as layoffs. Through financial education, this can fortify individuals against these and other types of negative financial shocks. This is referred to as financial resiliency. Financial resilience refers to the ability of individuals to be able to resist, cope, and recover from negative financial shocks (Mcknight, A., & Rucci, M. (2020 ) that one may encounter throughout life. As a result of financial resiliency individuals are equipped to make sound financial decisions and achieve financial well-being all due to their improved knowledge, skills, attitudes, and behaviours (Mcknight, A., & Rucci, M. 2020). For instance, in Singapore’s MoneySense Program (Singapore’s MoneySense Program, retrieved 7/5/2024), participants are taught money management, financial planning, and investment strategies. These components were considered to result in effective outcomes of participants making informed decisions, while at the same time positively affecting their lives and the larger economy.

Rehabilitation programs in the prison system often focus on GED related educational services, and various forms of trade job related activities (i.e. HVAC, plumbing). These programs have been proven to be effective against recidivism. In fact, the Vera Institute of Justice found that inmates who participated in correctional education programs were 43% less likely to return to prison within three years of release compared to those who did not participate (Vera Institute of Justice, retrieved 7/5/2024). Although some programs have begun to incorporate financial components of budgeting into prison programs, there remains a dearth in the literature in terms of proving its’ effectiveness. More research is needed to document both the short and long term impact of financial education for those within the prison system, as well as those who have been released. In addition, understanding the association between the correlations of financial education on various adjustment variables to reintegration would be beneficial as organisations strive to implement effective and successful strategies into their programs. Programs such as First Step Alliance, a non-profit organisation based in New Jersey is one of a few organisations that provides free financial education and credit counselling services to formerly incarcerated individuals. With an emphasis on topics of budgeting, improving credit, and saving for retirement, their goal is to ensure that their participants have the financial knowledge and resources they need to avoid the possibility of them returning to criminal activities for financial reasons (First Step Alliance, November 26, 2023).

Also of significance, building and empowering communities with sound financial knowledge is essential to sustainability and resilience in a changing world. This aims to articulate the argument that financial education is ‘worth it’ for families, communities, and, indeed, society. It also calls upon the incarceration community to begin to recognize the transformative power of the teaching of accounting and finance (Surya et al. 2021).

-

The Importance of Financial Education in Prisoner Re-Entry Programs

Financial education is gradually gaining more visibility in social policies. We argue that further prisoner re-entry programs would benefit from having an integral economic component, especially through the naming and strengthening of practical financial skills (Worthington, 2022).

Financial education acknowledges the skills that are necessary to survive in the community; for community-based organisations, that means recognising the importance of money management. In addition to money management and budgeting, additional skills that are necessary include helping people navigate their current credit situation and truly understand what credit is and how it directly impacts people’s financial well-being. In many ways, effective prisoner re-entry reinforces economic security as part of the process of empowerment back into society. In talking about prisoner re-entry, it is stated that social interventions designed to prevent returning prisoners from falling into poverty make long-range community stabilisation more achievable (Skinner-Osei & Osei, 2020). Those individuals who leave prison with financial motivations are likely to look for employment, construct a more sustainable income, and ultimately achieve better possibilities of post-release success, even perhaps having more hope in their chances to stay out of prison.

Incarceration, by definition, disrupts an individual’s work life and, hence, income. People who do not have experience in budgeting for long-term financial needs often find it difficult to connect with credit counselling and debt management programs. By including financial education, not only are agency components such as employment, correctional industries, and probation of reduced need, but former prisoners are less likely to recidivate. In fact, stressors, such as difficulty paying rent or mortgages or increased impulses to engage in retail theft or other get-rich-quick strategies, will become less prevalent should a client go through monetary management early (Harper et al., 2021). It is noted that, though the evidence is scarce, it can also affect what job former prisoners will get in the community. It is also indicated that, after controlling for unobserved differences between individual households, financial literacy directly affects location choice outside of prison, particularly in terms of housing choice, and there may be an association between this choice and recidivism.

2.1. Challenges Faced by Formerly Incarcerated Individuals

Entering society post-release from prison poses significant challenges for formerly incarcerated individuals. They must contend with a variety of obstacles that directly result from each person’s incarceration period. These obstacles influence physical limitations due to prison life exposure, mental limitations from exposure to prison life, and emotional and social limitations. In addition to these disadvantages, post-release life includes employment-related barriers. Employers are sceptical of hiring someone with a criminal record, fearing their reasons for that record and its implications for employee turnover for this population. As a result, few employers are interested in hiring individuals who face the stigma surrounding criminal records (Walker, 2023). This is exacerbated by the fact that these individuals often do not have the credentials necessary to obtain viable work in the labour market and rarely have the financial resources necessary to post bail or obtain a good attorney before their court case concludes in conviction or acquittal.

Housing is another barrier often faced by this population. This population does not typically have housing upon re-entry. Oftentimes, there is a lack of permanent housing available, and public assistance organisational resources may no longer be applicable upon immediate release. This is problematic, as this population is more likely on average to experience mental health issues in addition to a lack of financial resources (Maier, 2021). As a result, they may have an inability to properly manage stressors like stable housing. Furthermore, they may often not have enough of a marketable skill set to maintain said housing above the poverty line limit. Thus, access to mental health services, housing, and municipal resources, in addition to successful release planning, is of acute importance when releasing these individuals into society.

2.2. Benefits of Integrating Financial Education

A growing amount of evidence illustrates that it is invaluable to provide financial education as part of re-entry services to improve outcomes for formerly incarcerated individuals and therefore for steadfast societal reintegration. Providing people with financial literacy has been found to help develop and enhance several important life skills, including better decision-making and the ability to prioritise their lives and maintain employment. Employers are increasingly seeking candidates who have demonstrated the capability to complete a program that provides a level of financial management (Trivedi and Ray, 2024). Additionally, teaching financial education in conjunction with soft skills certainly improves participants’ quality of life, such as increased self-confidence, higher levels of mental health, and greater trust and willingness to become civically engaged. This can lead to the development of a stronger sense of self, resilience, and the ability to weather setbacks, all skills that are necessary following a period of incarceration.

Research has shown that formerly incarcerated individuals struggle more than others in paying bills on time, in some instances to a disabling degree. A range of programs produce strong evidence that providing financial readiness training upon re-entry lessens rates of recidivism. From a purely operational point, getting someone out of the cycle of offending even for just one year can generate sufficient social return on investment required to impact employment agencies. By offering people struggling to pay bills safely and without risking the loss of assets, financial training allows them the necessary time to find a job and make enough money to avoid devastating financial consequences (Petrich et al., 2022). Providing financial counselling for unemployed people can indeed have a lasting effect, even momentarily reducing the rate of low-income households in which individuals report stimulating credit card debt due to lack of volunteer work or unemployment. These examples underscore the need to show that integrating financial education during re-entry can lead to a sustainable path forward following release from incarceration.

-

Public-Private Partnerships in Supporting Financial Education Programs

As we continue to explore financial education programs aimed at promoting successful re-entry for the previously incarcerated, we must remember the necessity of collaborating with other sector lines when supplying resources for these services. Specifically, public-private partnerships can offer up-to-date financial education training, pathways to work experience opportunities, internships, job and entrepreneurial development, and administrative services all designed to enhance these programs. To be most effective, financial education program managers should build or further develop partnerships between government agencies and organisations including non-profits, housing agencies, workforce organisations, banks and credit unions, and other public and private organisations to achieve broad dissemination and access to current tools and information.

In federal program evaluations providing financial literacy information across select prison complexes, over 70 institutions received a significant volume of publications, resources, and speaker requests. In a voluntary survey, 65 institutions claimed they have provided a dynamic financial education program since 2013 (Baker et al., 2022). Additionally, individuals representing 68% of each state prison facility expressed interest in providing or receiving some form of financial literacy training as part of the re-entry process. Private companies managing re-entry services in every state provide at least some financial literacy as a part of comprehensive re-entry programming. Overall, public, private, and non-profit groups provide resources compatible with the training they offer. In 2013, all programs that had been studied, received at least some federal support. In terms of resources, the mix is equally critical. With are state-managed agencies, a broader network providing access to financial services or resources is more likely to have sustainability advantages.

-

Impact of Financial Education on Recidivism Rates

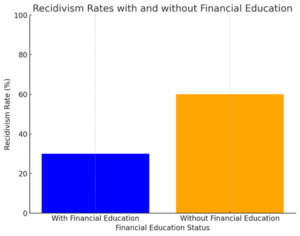

Research investigating the effect of financial education on recidivism rates has shown strong evidence of the importance of financial literacy training in the re-entry process. This research shows that it is possible to reduce the chance of re-incarceration by more than 30% if an individual receives financial support and is aware of the consequences of his or her financial decisions (Harper et al., 2021). This reduction can be obtained by helping inmates understand their financial situation and make more informed decisions to rebuild their lives when they are released from prison. Additionally, new research and analysis in this field appear to confirm the relevance of the variables presented for analytic re-offense data, according to statistical data from economic strategies and financial decisions obtained from focus groups.

Figure 1 illustrates a bar chart showing the difference in recidivism rates between formerly incarcerated individuals who received financial education as part of re-entry programs and those who did not.

Figure 1 (Harper, Ginapp, Bardelli, et al., 2021).

According to the analysis and the case studies reported, financial education has an important effect on recidivism rates because of the mechanisms through which it works. It is commonly believed that a reduction in criminal behaviour can be achieved through improved social and emotional skills or cognitive thinking, but financial literacy is also important. Financial education can be effective as offenders make decisions because they gain a better understanding of the direct and indirect costs and benefits for different options (Loeffler & Nagin, 2022). In some instances, they also developed an increased orientation toward long-term structuring of their lives, which facilitates making decisions to avoid crime. This insight on behaviour is consistent with conventional deterrence theory, whereby individuals compare the advantages and disadvantages before making a decision. The finding suggests the greater effectiveness of economic-based crime prevention approaches. It also helps build supportive environments aimed at reducing recidivism and helping inmates not only to make wise decisions but regain control of their lives once the re-entry process is completed. The use of robotics could also be utilised to help perform a wide range of tasks (Surao, 2018) to assist during the re-entry process.

-

Sustainable Development and Broader Societal Resilience

Sustainable development addresses the five Ps of economic activity, namely, people, profit, prosperity, planet, and peace. Traditionally seen as a synonym for a system’s ampliative capacity in the wake of disturbance, resilience has more recently been recognized as a capability of both cities and communities in accommodating chronic social disparities, contingent climate risks, and economy-induced disasters. The acknowledgment of the broader framing opened up the societal resilience and sustainability discussion. Empirically, financial education programs carried out particularly in underdeveloped communities were once linked to the concept of sustainability.

Figure 2 illustrates a pie chart showing the distribution of common financial stressors faced by individuals upon re-entry

Figure 2 ( Williams, 2022).

Economic literature has differentiated the terms “sustainability” and “development,” documenting that the former conveys an idea of continuity, equilibrium, and silent growth, while the latter underscores the series, spirited, and dynamic occurrence. In society, sustainability denotes the evolution of human society, a process determined by the dynamic merge and consolidation of several factors in a multidimensional and complex connection. Equitable or unequal access to decision-making might create or hamper a more participative society; therefore, the power for one to have control to make decisions regarding their well-being, their family and the community in which they live is also a fundamental pillar of sustainability. Recognising the ethical consideration in defining “power” can produce a more or less inclusive meaning of the concept, and power relations might result in exclusion or disempowerment. Similarly, sustainable communities are seen as being better equipped to handle crises, have a given level of liveability, and can promote personal and institutional development. In this paper, a parallel was made among all these definitions with the transparency pillar of the principles to alleviate these components through the utilisation of financial education programs and building a theoretical framework on “resilience and sustainability” for both subject matters.

-

Conclusion

In summary, the previous analysis spotlights the links among financial education, the re-entry process, and, by extension, the creation of sustainable and resilient communities. These insights contribute to a rich, systemic understanding of the relationships between financial literacy and resilience, and the need for change, and transformative outcomes. Financial education is powerful and can contribute to improving an individual’s life and outcomes for an entire community. At heart, it is a practical approach to preventing impoverishment; recognizing that financial issues and daily life scenarios are continuous. With the implementation of basic financial tools and reintegration preparedness, recidivism can be counteracted. Both issues highlighted by this scenario desperately need attention and comprehensive responses. The practical changes; financial education and re-entry programs, demonstrated contribute to enhancing the principles of sustainability. The strengths and coordinated collaborative efforts of each entity (public and private sectors) geared at addressing the unique needs of formerly incarcerated individuals in the context of financial resilience and sustainability are critically needed. These programs can potentially reduce recidivism rates and promote successful reintegration. Most importantly, these efforts have the capacity to improve lives and build strong sustainable and resilient communities. This is our challenge and our opportunity. We pose these ideas as challenges and to stimulate research and discussion.

References:

Baker, T., Mitchell, M. M., & Gordon, J. A. (2022). Prison visitation and concerns about reentry: Variations in frequency and quality of visits are associated with reentry concerns among people incarcerated in prison. International Journal of Offender Therapy and Comparative Criminology, 66(12), 1263-1284. [HTML]

First Step Alliance. (2023, November 26). Financial education & recidivism. https://www.firststepalliance.org/post/education-and-recidivism

Harper, A., Ginapp, C., Bardelli, T., Grimshaw, A., Justen, M., Mohamedali, A., … & Puglisi, L. (2021). Debt, incarceration, and re-entry: A scoping review. American Journal of Criminal Justice, 46, 250-278. springer.com

Loeffler, C. E. & Nagin, D. S. (2022). The impact of incarceration on recidivism. Annual review of criminology. read-me.org

Maier, K. (2021). ‘Mobilizing’prisoner reentry research: Halfway houses and the spatial-temporal dynamics of prison release. Theoretical criminology. [HTML]

Mcknight, A., & Rucci, M. (2020). The financial resilience of households: 22 country study with new estimates, breakdowns by household characteristics and a review of policy options. Centre for Analysis of Social Exclusion, London School of Economics.

Monetary Authority of Singapore. (n.d.). MoneySense -Singapore’s National Financial Education Programme. Retrieved 7/5/2024, from https://www.moneysense.gov.sg/

Petrich, D. M., Cullen, F. T., Lee, H., & Burton, A. L. (2022). Prisoner reentry programs. Handbook of issues in criminal justice reform in the United States, 335-363. [HTML]

Skinner-Osei, P. & Osei, P. C. (2020). An Ecological Approach to Improving Reentry Programs for Justice-Involved African American Men.. Journal of Prison Education and Reentry. ed.gov

Surao, A. (2018). Design and Implementation of Plc Based Robot Control of Electric Vehicle. Mathematical Statistician and Engineering Applications, 67(1), 33–43.

Surya, B., Suriani, S., Menne, F., Abubakar, H., Idris, M., Rasyidi, E. S., & Remmang, H. (2021). Community empowerment and utilization of renewable energy: Entrepreneurial perspective for community resilience based on sustainable management of slum settlements in Makassar City,

Indonesia. Sustainability, 13(6), 3178. mdpi.com

Trivedi, C., & Ray, S. M. (2024). Equity, Empowerment, and Social Justice: Social Entrepreneurship for Formerly Incarcerated Individuals. New Horizons in Adult Education and Human Resource Development, 36(1), 48-64. researchgate.net

Vera Institute of Justice. (n.d.). Unlocking Potential Initiative: Expanding high-quality postsecondary education in prison. Retrieved 7/5/2024, from https://www.vera.org/ending-mass-incarceration/dignity-behind-bars/college-in-prison/unlocking-potential-initiative

Walker, S. (2023). Beyond Incarceration: Identification of Post-Incarceration Strategies for Successful Reintegration. waldenu.edu

Williams, J. (2022). Mass Incarceration, Prison Release and HIV Infection in Florida Counties, 2015–2019. [HTML]

Williams, J. (2022). Mass incarceration, prison release, and financial challenges upon re-entry: A comprehensive review. Journal of Offender Rehabilitation, 61(1), 15-35. https://doi.org/10.1080/10509674.2021.1999183

Worthington, C. A. (2022). Strategies for Developing and Implementing Prisoner Reentry Initiatives: A Basic Qualitative Study. [HTML]