Written by: Nikita Rai

Numerous students in higher education have experienced turbulence during the covid-19 pandemic as they aimed to continue learning through different technological mediums. Now that the cost of living is rising, students are faced with another challenge relating to student loan repayments and supporting themselves within the new normal.

Student loans

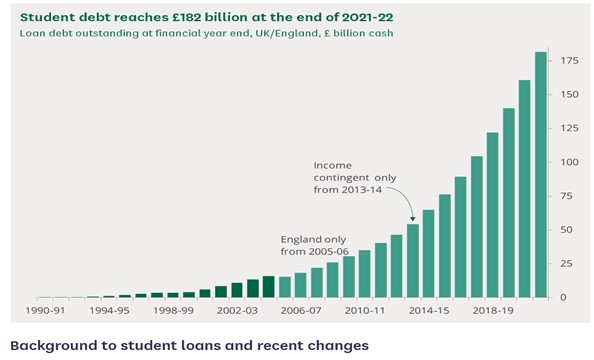

The primary method of students acquiring direct government support in their endeavour to gain higher education in the UK, is via student loans. During this process, students are loaned money at a subsidised rate to facilitate them towards managing their tuition fees and maintenance costs. Within England, approximately £20 billon is loaned to approximately 1.5 million students. According to student loan statistics the loans outstanding at the end of March 2022 had reached £182 billion. It is predicted that this will rise by the middle of 2040 to approximately £460 billion based on the 2021-22 prices. Therefore, it is predicted that after course completion, students that started their courses in 2021/22 will have a forecast average debt of approximately £45,800. However, due to the introduction of the reformed system, there is a prediction that students starting higher education from 2023 to 2024 will have a debt of approximately £43,400. The UK Government have an expectation that they will be paid in full by twenty percent of full-time graduates that start in 2021 to 2022. In addition, there is a further expectation that this percentage would increase to fifty-five percent from students starting in 2023 to 2024 due to the 2022 reforms.

Frozen Thresholds

The UK Government have taken the decision to freeze thresholds that student borrowers repay from their student loans. The amount is £27,295 in 2022 to 2023 and has an impact upon those borrowing in England. Historically student loans have annually increased dependent upon earnings, for example if the thresholds have increased dependent on average earnings, in 2022 to 2023.95 the amount would be £28,525. Hence, approximately repayments of approximately £110 more would need to be paid during the 2022 to 2023 year. Needless to say, it is likely that current borrowers will pay more in the future due to the fact in 2023 to 2024 thresholds will be frozen once again. Per year this amount will increase based upon the Retail Price Index which is usually lesser than the rise in average earning.

Student Maintenance Support

During the 2021 to 2022 academic year, the UK Government increased the maximum maintenance loan amount pertaining to undergraduate students studying England by 3.1%. If compared to the CPI inflation rate which was 6.2%, the increased maximum maintenance loan amount of 3.1% is significantly lower. It is envisaged that by the 2022 to 2023 academic year, the maintenance loan amount will increase by 2.3% in comparison to the expected CPI inflation rate of 8.1%. Therefore, it is expected that by 2021/22 and 2022/23 there will be a decrease of approximately 11% maintenance support, which can equate to approximately £1,100 according to the Library briefing. The forecast of inflation is dependent upon the annual uprating for maintenance support; thus, the price cuts will not be automatically applicable for future rises, in comparison to benefit uprating.