Research Objectives:

The research aims to evaluate how many elements, including investment decisions, perceived benefits and risks, trustworthiness and credibility, market volatility, and social and psychological impacts, influence investor perspectives.

Keywords:

Financial innovation, Investor perception, Return on Investment, Market volatility, Investment choices.

BIO

Prof. Pankaj Choudhary is the Principal of BMS College of Commerce & Management, Dean at BMS Centre for Executive Education and Director at BMS Academy for Professional Courses. He has more than 2 decades of work experience in various domain of Educational Industry. Dr. Pankaj is also the Syndicate Member and Academic Council Member at Bengaluru City University and many more educational institutions in India. Dr. Pankaj has been instrumental in establishing several educational institutions in India. He has published more than 20 research papers in the areas of Finance, Accounting, Portfolio Management and Marketing. Dr. Pankaj Choudhary is recipient of several prestigious awards in last few years.

Abstract

This study examines the factors that influence investor perceptions of financial innovations in Karnataka. Given the rapid evolution of financial products and services, it is essential to comprehend investor attitudes and behaviours in order to effectively implement and absorb these innovations. The research aims to evaluate how many elements, including investment decisions, perceived benefits and risks, trustworthiness and credibility, market volatility, and social and psychological impacts, influence investor perspectives. The study utilized a mixed-method approach, integrating quantitative surveys and qualitative interviews to collect extensive data from a varied range of investors in several districts of Karnataka. The key findings suggest that urban investors have a greater willingness and comprehension of financial innovations, but rural and semi-urban investors approach them with cautious optimism due to restricted access to information and lower levels of financial literacy. The study emphasizes the significance of focused educational programs and clear communication by financial institutions to improve investor understanding and confidence in financial innovations. This research enhances the broader discussion on financial inclusion and the successful implementation of financial innovations in emerging markets by offering a detailed knowledge of the elements that influence investor opinions.

INTRODUCTION

The modern economy relies on an efficient financial system, which encompasses markets, instruments, institutions and regulations. This system facilitates the trading of financial securities, determines interest rates, and produces and delivers financial services globally. The financial system is widely recognized as a crucial innovation of contemporary civilization, functioning as an integral component of the economic and social systems. The modern financial system is characterized by a rapid and significant rate of innovations, both in terms of quantity and value. Financial innovation is essential in influencing the worldwide economic environment through the introduction of novel financial goods, services, and procedures. In recent years, financial markets have experienced notable progress, propelled by technological developments, regulatory reforms, and market demand. These financial advances have significantly affected several parts of the stock market, which in turn effects investor perception and investing decisions. These modifications can encompass upgraded technology, risk mitigation, risk transfer, credit and equity development, along with several other improvements. Notable recent advancements in the financial sector encompass crowd funding, mobile banking technology, and remittance technology.

BACKGROUND OF THE STUDY

Financial innovations are crucial for fostering economic progress in any region. They facilitate the funding of small and mediumsized firms and enable the efficient mobilization of local resources. Financial innovations have a crucial role in shaping the evolution of financial technology and banking processes. Financial innovations decrease the number of intermediaries and the costs associated with transactions, while also aiding in the expansion, intensification, and integration of financial markets. Consequently, this mechanism expedites economic expansion by incentivizing savings, investments, and production. The development of innovation is crucial, but the adoption of innovation is equally vital. The rapid advancement of innovation, structural shifts in globalization, and deregulation in recent years have significantly transformed both domestic and international financial institutions. Financial innovations have significantly enhanced the efficiency of global financial markets, mostly by offering a broader array of instruments that offer higher adaptability. Financial innovations have a crucial role in facilitating the functioning of the economy. Credit/debit cards, cheques, and ATMs are innovative products that have increased the speed at which money is exchanged. Financial innovations are essential and pivotal in any economy. These advancements act as foundational supports for the financial system and the market for investments. The prevailing characteristic of the contemporary financial system is its rapid rate of innovations, encompassing both their quantity and value. This study seeks to examine the impact of financial innovations and investor views in relation to Karnataka.

FINANCIAL INNOVATIONS – CONCEPT AND DEFINITION

Financial innovations refer to the process of developing and subsequently promoting novel financial instruments, technology, institutions, and markets. It encompasses institutional, product, and process innovation. Information and communication technologies (ICT) are revolutionizing the way users obtain financial products.

Financial advancements have been present since the inception of technology innovations. The close relationship between financial and technical advancements is widely recognized, as they both progress in tandem over time. Proper management of innovation, knowledge, information, reputation, and trust is essential for the sustained growth of a modern company unit. Initially, the term “innovation” referred to the modifications in technological solutions that resulted in the creation of new combinations of productive resources. These changes led to higher than average rates of return and thus stimulated the dynamic growth of the total economy. The innovations are developed in response to the need of business entities seeking to get a competitive edge in their business environment. However, the demand can be driven either by the internal requirements of the corporate entity seeking to enhance its operations or by the external changes in its environment necessitating the appropriate adaptation in its business plan.

INNOVATION IN FINANCIAL PRODUCTS

Managing innovation is the deliberate and organized approach to implementing changes with the goal of enhancing a company’s goods, operations, or overall standing. In order for a company’s innovation initiatives to be successful, the market must react favourably, either by increasing sales or customer satisfaction, improving the company’s public image, or enhancing interactions among employees and different divisions within the organization. It is crucial to maintain a delicate equilibrium between safeguarding the organization’s long-term sustainability and avoiding any potential harm caused by new ideas. To comprehend innovation, one must not just concentrate on the quality of the items.

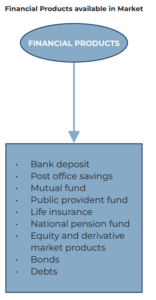

Investors have the opportunity to choose from a diverse array of financial investment possibilities. The diverse investment possibilities encompass equity shares, preference shares, debentures, bonds, gold, fixed deposit accounts, money market funds, mutual funds, real estate, life insurance and pension plans, government securities, derivatives, and other alternatives. When engaging in investment activities, the investor was required to analyze the risk and potential return of multiple investment possibilities, and perform fundamental research for each of these assets. Financial products are investment instruments that are purchased with the anticipation of earning profitable returns. These financial instruments enable investors to engage in investing, savings, insurance, and mortgage acquisition. Investors employ these tools to attain both long-term and short-term financial gains. The Indian market provides a diverse range of products to meet the investment requirements of individuals, encompassing both long-term and short-term objectives. Several of these products comprise:

Figure: 1

-

SIGNIFICANCE OF FINANCIAL INNOVATION

Financial innovation is the process of developing and subsequently promoting novel financial instruments, as well as new financial technologies, institutions, and markets. The “innovations” can be categorized as either product or process innovation. Product innovations refer to the introduction of new derivative contracts, new corporate securities, or new forms of pooled investment products. Process improvements, on the other hand, involve the development of new methods for distributing securities, processing transactions, or pricing transactions. In reality, even this seemingly harmless distinction is rarely well-defined, as process and product innovation are frequently interconnected. Innovation includes the processes of creating and spreading novel products, services, or ideas. However, it is worth noting that many financial innovations are actually modifications of existing products. Financial innovation serves six distinct roles:

- Transferring funds between different time periods and geographical locations (e.g., between savings accounts)

- The aggregation of financial resources (such as mutual funds)

- Overseeing risk management, including insurance and various derivative products

- Gathering data to facilitate decision-making (markets that offer price data, such as credit-default swaps markets)

- Tackling issues of moral hazard and asymmetric knowledge (in the context of venture capital businesses)

- Enabling the exchange of goods and services by utilizing a payment mechanism involving credit cards.

-

FINANCIAL INNOVATION AND INVESTOR PERCEPTION

Financial innovation plays a significant role both domestically and internationally by facilitating the smooth execution of financial transactions. Financial innovation is said to convert a stagnant economy into a dynamic one by promoting the creation of capital, stimulating private investment, facilitating financial intermediation, and increasing the tendency to save. Consequently, attaining a greater level of economic growth is possible. Investment decisions are of utmost importance for people’ financial welfare and the general operation of financial markets. The process of formulating investment decisions is intricate and subject to a multitude of elements, encompassing economic and financial concerns as well as psychological and behavioural aspects. Comprehending these characteristics and their influence on investment decisions is crucial for investors, financial experts, and regulators alike. Investment decisions can be greatly influenced by economic and financial considerations, including market circumstances, interest rates, inflation, GDP growth, industry performance, and market sentiment. These characteristics determine how investors perceive risk and return, which in turn affects their decisions on how to allocate their assets and develop investing strategies. Financial innovation has the potential to enhance investor perception by demonstrating a company’s dedication to ensuring investor happiness. Moreover, financial innovation has the potential to improve investor perception by demonstrating a company’s dedication to maintaining a sustainable competitive edge, addressing the concerns of stakeholders, and effectively balancing innovation and efficiency.

The perception of investors plays a vital role in influencing the economic and financial performance of a corporation. Companies that are viewed as innovative, responsible, and sustainable are more likely to garner favourable attention from investors and secure greater amounts of investment. Financial innovation plays a vital role in boosting investor perception by demonstrating a company’s dedication to sustainability. Additionally, financial innovation can boost sales revenue and market share, further strengthening investor perception.

-

FINANCIAL INNOVATION (FI) AND INVESTMENT DECISIONS (ID)

Currently, the world is at a period where the additional benefits gained by novel technologies are still greater than the additional costs incurred by using them. Financial innovation, which involves the creation and implementation of novel financial products, technology, and procedures, has significantly altered the investment decision-making environment. Financial innovation is the process of developing and promoting novel financial instruments and technology. Financial Innovation (FI) in this study pertains to the implementation and acceptance of novel financial products, technology, and procedures in the banking industry. It encompasses technological progressions including financial technology platforms, crypto-currencies, crowd-funding, algorithmic trading and robo-advisors. Financial innovation directly impacts investment decisions by introducing new investment options and altering risk-return profiles. It is important to emphasize that, in this particular situation, investment options are not considered as a singular sum of investment, but rather comprise a wider range of strategic choices in distributing financial resources.

-

REVIEW OF LITERATURE

Jean Baptiste Bernard Pea-Assounga et al. (2024) stated that the technology innovation factor is known to have an impact on the happiness of stakeholders such as customers and employees, as well as on bank performance and investment decisions. This study sought to examine the impact of financial innovation, specifically the innovation component, on investment decisions. It also considered the influence of stakeholders’ satisfaction and the bank’s performance as mediators, as well as the moderating role of Internet security (IS). The data for this analysis was collected from 575 employees and customers of banks in Congo. This study enhances the existing financial literature and bank management by providing ideas and a framework that help in identifying relevant strategic resources and constructs. Pranjal Shah (2023) carried out an extensive analysis of the primary elements that influence investing choices, utilizing a diverse array of scholarly literature and empirical research. The study commences by highlighting the significance of psychological elements in investment decision-making. The study analyzed behavioural biases such as anchoring, loss aversion, and herding behaviour, and how these influence investment decisions. In addition, the study examines the impact of external influences on investing choices. The analysis focuses on macroeconomic variables such as interest rates, inflation, and fiscal policies, and their impact on investment decisions. In addition, it takes into account regulatory factors, market structure, and technology improvements as significant external influences. Mayank Jain (2023) examined the influence of green technical breakthroughs and quality management on the financial performance and perceived value of manufacturing enterprises from an investor’s perspective. The study also examined the impact of environmentally-friendly process and product improvements on financial performance and investor perception. The results indicated a strong and positive relationship between the development of eco-friendly products and how investors perceive a company. This suggests that organizations that prioritize environmental responsibility are more likely to attract greater investments and enhance their financial outlook. Nevertheless, there was no notable positive association observed between green process innovation and financial performance, possibly due to the impact of initial expenses and delayed advantages. In her study, Shapoval (2021) determined that industrialized countries mostly depend on financial depth and financial innovations, with institutional development playing a comparatively smaller role, to achieve economic progress. The economy’s growth was heavily dependent on financial developments. These improvements lead to an increase in the total quantity of savings and investments. Riyaz Ahmed (2021) conducted a survey with 753 investors. He concluded that the important factors influencing investor choices include the type of investment, the investor’s personal attributes, their behavioural characteristics, their options, and their understanding of mutual funds and shares. In his study, Pernell (2020) identified that new products have the potential to yield substantial profits for investors. However, it is important to note that these items can also be intricate and pose significant risks. In addition, the author elucidates the manner in which these financial products might precipitate economic volatility. Additionally, it was determined that these advances have the potential to undermine both official and unofficial financial markets.

-

RESEARCH GAP

After conducting an extensive analysis of the existing literature, it has been determined that numerous research are presently concentrated solely on financial innovation in developed nations. There is a scarcity of empirical research about financial innovation in India specifically in the state of Karnataka. These investigations are characterized by their descriptive nature. Most academic tasks pertain to advancements in concerned financial institutions. In the case of India, there is a scarcity of studies that examine the relationship between financial innovation and investor perception. These studies solely focus on enumerating the various financial innovations that benefit the investors, without establishing any connection to the factors that prompted the development of these innovations at the individual firm level.

-

STATEMENT OF THE PROBLEM

The field of financial innovation is extensive, but the existing literature on this topic is relatively limited and dispersed across various disciplines. In contrast to other areas covered in this volume, where significant advancements have been made, the subject of financial innovation remains largely unexplored and holds potential for intriguing discoveries. This exemplifies the vast capacity for scholars and researchers in this domain. The current study aims to fill three notable research deficiencies. This study initially examines the diverse aspects that impact an investor’s views about new financial products. Additionally, it will evaluate the impact of financial innovations on investor’s choice of investment, security concerns and market volatility. The study will also reveal the impact of financial innovations on investors’ return on investment with trust and credibility they maintain over the financial products.

-

RESEARCH OBJECTIVES

- To provide an overview of financial innovation and its significance among investors

- To analyze the various elements that influence financial innovations

- To evaluate the influence of various factors on investor perceptions towards financial innovations

-

RESEARCH METHODOLOGY

Research methodology refers to the systematic and scientific strategy employed to carry out research and gather data for a study. The process entails a sequence of procedures that are adhered to in order to guarantee that the research is carried out in an impartial, dependable, and valid approach. The primary objective of the study is to assess the influence of financial innovations and investor perceptions on the decision-making process.

The present empirical study work utilized a Descriptive research strategy. The study made use of both primary and secondary data. The primary data from the respondent investors was gathered from two specific areas in Karnataka, namely Bangalore and Mysuru. This was done using a systematic approach that involved a standardized questionnaire and direct interviews. The initial section of the structured questionnaire focuses on the demographic characteristics of the participants and includes both open-ended and closed-ended inquiries. The second portion of the questionnaire includes variables (such as investment choices, market volatility, security concerns, trust & credibility and return on investment) that are associated with investors’ assessment of financial innovation. The researchers employed a Likert scale as a measurement instrument to assess the degrees of perception among the investors who participated in the study. The secondary data was gathered from a variety of sources such as books, magazines, reports, research articles, and websites. The data from the identified respondents was collected using the convenience sampling approach. The study was carried out among the investors residing in the districts of Bangalore and Mysuru in the state of Karnataka. A total of 221 respondents, who were investors, were interviewed and data was collected from them using the schedule technique. The data was examined using statistical procedures such as percentage analysis, chi-square test, ANOVA, and SEM, utilizing the SPSS software.

-

DATA ANALYSIS

One way ANOVA (Age)

H01: There is no significant difference between age groups with regards to the investment choices, market volatility, security concerns, trust and creditability and return on investment..

| Table – 1: Age Groups Vs Various Dimensions | ||||||||

| Dimensions | Sum of Squares | Df | Mean Square | F | Sig | Statistical Inference | ||

| Investment Choices | Between Groups | 105.968 | 3 | 35.323 | 3.492

|

.010

|

Significant | |

| Within Groups | 2194.793 | 217 | 10.114

|

|||||

| Total | 2300.760 | 220 | ||||||

| Market Volatility | Between Groups | 295.364 | 3 | 98.455 | 9.712

|

.000

|

Significant | |

| Within Groups | 2199.876 | 217 | 10.138

|

|||||

| Total | 2495.240 | 220 | ||||||

| Security Concerns | Between Groups | 152.815 | 3 | 50.938 | 4.184

|

.007

|

Significant | |

| Within Groups | 2641.637 | 217 | 12.173

|

|||||

| Total | 2794.452 | 220 | ||||||

| Trust and Creditability | Between Groups | 281.067 | 3 | 93.689 | 7.841

|

.000

|

Significant | |

| Within Groups | 2592.770 | 217 | 11.948

|

|||||

| Total | 2873.837 | 220 | ||||||

| Return on Investment | Between Groups | 209.193 | 3 | 69.731 | 7.590

|

.000

|

Significant | |

| Within Groups | 1993.576 | 217 | 9.187

|

|||||

| Total | 2202.769 | 220 | ||||||

* Significant at the 5% level

Interpretation

It is determined that there is a statistically significant difference between the age groups because the significant (p) values for investment choices, market volatility, security concerns, trust and creditability, and return on investment are less than 0.05, the threshold of significance. Since the null hypothesis is rejected, it can be said that respondents’ average opinions on investment choices, market volatility, security concerns, trust and creditability, and return on investment are similar regardless of their age.

As a result, there are notable differences across age groups when it comes to return on investment, trust and creditability, security concerns, market volatility, and investment choices. The null hypothesis is therefore disproved.

One way ANOVA (Education)

H02: There is no significant difference between education groups with regards to the investment choices, market volatility, security concerns, trust and creditability and return on investment.

| Table – 2: Education Groups Vs Various Dimensions | ||||||||

| Dimensions | Sum of Squares | Df | Mean Square | F | Sig | Statistical Inference | ||

| Investment Choices | Between Groups | 23.955 | 2 | 11.977 | 1.147

|

.320

|

Not Significant | |

| Within Groups | 2276.805 | 218 | 10.444

|

|||||

| Total | 2300.760 | 220 | ||||||

| Market Volatility | Between Groups | 21.891 | 2 | 10.945 | .965

|

.383

|

Not Significant | |

| Within Groups | 2473.349 | 218 | 11.346

|

|||||

| Total | 2495.240 | 220 | ||||||

| Security Concerns | Between Groups | 49.773 | 2 | 24.887 | 1.977

|

.141

|

Not Significant | |

| Within Groups | 2744.679 | 218 | 12.590

|

|||||

| Total | 2794.452 | 220 | ||||||

| Trust and Creditability | Between Groups | 51.312 | 2 | 25.656 | 1.982

|

.140

|

Not Significant | |

| Within Groups | 2822.525 | 218 | 12.947

|

|||||

| Total | 2873.837 | 220 | ||||||

| Return on Investment | Between Groups | 66.253 | 2 | 33.126 | 3.380

|

.036

|

Significant | |

| Within Groups | 2136.516 | 218 | 9.801

|

|||||

| Total | 2202.769 | 220 | ||||||

* Significant at the 5% level

Interpretation

It is determined that there is no statistically significant difference between the education groups since the significant (p) values for investment choices, market volatility, security concerns, trust, and creditability are less than 0.05, the threshold of significance. Since the null hypothesis is disproved, it follows that respondents’ opinions on return on investment are generally the same, regardless of their degree of education.

As a result, there are notable differences in return on investment amongst education groups. The null hypothesis is accepted since there is no discernible difference between the education groups in terms of investment decisions, market volatility, security concerns, trust, or creditability.

SEM Path Analysis

Source – AMOS output

Table – 3: Testing of Hypothesis

| Variables Relationship | Estimation | SE | CR | P-Value |

| Trust and Creditability <— Investment Choices | 0.166 | 0.079 | 2.106 | 0.035 |

| Trust and Creditability <— Market Volatility | 0.241 | 0.077 | 3.113 | 0.002 |

| Trust and Creditability <— Security Concerns | 0.450 | 0.075 | 5.959 | 0.000 |

| Return on Investment <— Trust and Creditability | 0.532 | 0.047 | 11.337 | 0.000 |

*Significant at 1% level

Discussion

H03 – Investment choices has no significant influence on trust and creditability

Table 3 indicates that the null hypothesis is accepted since the p-value is higher than the significant value (0.01). Therefore, trust and credibility are not much impacted by investment decisions.

H04 – Market volatility has no significant influence on trust and creditability

Table 3 indicates that the null hypothesis is rejected since the p-value is smaller than the significant value (0.01). Therefore, trust and credibility are significantly impacted by market volatility.

H05 – Security concerns has no significant influence on trust and creditability

Table 3 indicates that the null hypothesis is rejected since the p-value is smaller than the significant value (0.01). Thus, security concerns have a big impact on credibility and trust.

H06 – Trust and Creditability has no influence on return on investment.

Table 3 indicates that the null hypothesis is rejected since the p-value is smaller than the significant value (0.01). Therefore, trust and creditworthiness have a big impact on return on investment.

Result:

The research measured the overall fit (CMIN /df = 2.54), absolute goodness of fit (GFI = 0.909), incremental fit indices (CFI = 0.933), Tuker Lewis index (TLI = 0.921), and root mean square error of approximation (RMSEA = 0.069) in order to determine if the overall model was adequate. Literature analysis revealed that the ideal range for RMSEA is between 0.06 and 0.08, the CMIN/df should be less than 3.0, and the GFI, CFI, and TLI values may all be larger than 0.90. Thus, the number above indicates that the model fits well.

-

FINDINGS

- The age factor’s one-way ANOVA result reveals that there are significant variations across age groups in terms of return on investment, creditworthiness and trust, security concerns, market volatility, and investment options.

- The education factor’s one-way ANOVA result reveals that the return on investment for each education group varies noticeably. Since there is no appreciable difference between the schooling groups in terms of investment choices, market volatility, security concerns, trust, or creditworthiness, the null hypothesis is accepted.

- SEM results portray that according to a review of the literature, the GFI, CFI, and TLI values may all be more than 0.90, the CMIN/df should be less than 3.0, and the RMSEA should ideally be between 0.06 and 0.08. Consequently, the number above shows that the model matches the data well.

-

SUGGESTIONS

- It is necessary to provide education to newbie investors, as over 75% of investors have less than five years of experience.

- Financial institutions have the ability to create educational programs and provide materials that help improve the financial literacy of investors in relation to complex financial innovations. This can result in investors making better informed decisions when it comes to their investments.

- The financial sectors should prioritize their focus on goodwill and annual reports of corporations, as these are crucial variables in determining investor opinions.

- Investors should acknowledge the significance of financial literacy and make efforts to enhance their knowledge and comprehension of financial principles.

-

CONCLUSION

Sustainable financial innovations are necessary as they optimize the efficiency of the financial system, leading to improved economic growth and increased societal prosperity. Nevertheless, certain financial innovations might have adverse repercussions on the financial system, providing advantages to certain players while concurrently causing harm to others. Therefore, in order to effectively utilize a certain financial innovation, it is necessary to possess a comprehensive understanding of its operational mechanisms and conduct a meticulous examination of its outcomes. Financial innovation impacts investment decisions and the overall activities of a firm. Policymakers and financial service providers should consider these observations when tailoring regulations to successfully address the specific needs and concerns of investors in different places. In order to remain competitive and sustainable in their operations, policymakers must enhance their innovation and technological services. These studies indicate that financial innovation can positively impact investment decisions, hence impacting economic growth, alleviating financial limitations for enterprises, enhancing risk-sharing, and promoting entrepreneurial activity. Financial innovation offers organizations a valuable chance to maintain their competitiveness and prosper in a constantly changing business environment. This would ultimately foster a more inclusive financial ecosystem in Karnataka.

-

FUTURE RESEARCH

Additionally, the research can focus on certain subsets of investors, such as professionals, businessmen, or homemakers. Additional research can focus on a specific industry, while future investigations can delve into the factors contributing to the popularity of certain creative items in comparison to others. This will undoubtedly assist financial engineers in developing more appropriate policies and products.

REFERENCES

Abor, J. (2004). Technological innovations and banking in Ghana: An evaluation of customers’ perceptions. American Academy of Financial Management, 1, 1-16.

Alam, S. M. S., & Islam, K. M. Z. (2021). Examining the role of environmental corporate social responsibility in building green corporate image and green competitive advantage. International Journal of Corporate Social Responsibility, 6(1), Article 8. https://doi.org/10.1186/s40991-021-00062-w

Asmundson, I. (2011). What are financial services? How consumers and businesses acquire financial goods such as loans and insurance. Finance Dev, 48, pp. 46–47.

Frame, W & Lawrence, J. (2004). The diffusion of financial innovation; A examination of the adoption of Small Business Credit Scoring by Large Banking; 1187-1240.

Jain, M. (2023). Investor Perception, Green Innovation, and Financial Performance: Insights from Indian Manufacturing Firms. Futurity Economics & Law, 3(3). 6-30. https://doi.org/10.57125/FEL.2023.09.25.01

Jean Baptiste Bernard Pea-Assounga, H. Yao, G. Mulindwa Bahizire,P.D.R.Bambi,J.D. Nima Ngapey (2024) Effect of financial innovation and stakeholders’ satisfaction on investment decisions: Does internet security matter?, Heliyon volume 10,issue 6, E27242, https://doi.org/10.1016/j.heliyon.2024.e27242

Kneipp, J. M., Gomes, C. M., Bichueti, R. S., Frizzo, K., & Perlin, A. P. (2019). Sustainable innovation practices and their relationship with the performance of industrial companies. Revista de Gestão, 26(2), 94–111.

Merton, R., 1992, Financial Innovation and Economic Performance, Journal of Applied Corporate Finance, 4 (Winter), 12-22.

Michalopoulos, S., Leaven, L., Levine, R. (2009). Financial Innovation and Endogenous Growth. National Bureau of Economic Research, Working Paper 15356, Cambridge, September, p. 1-33.

Pernell, K. (2020) Market governance, financial innovation, and financial instability: lessons from banks‘adoption of shareholder value management. Theor Soc 49, 277–306

Pranjal Shah (2023) A study on factors affecting an investment decision, International Journal of Advance Research, Ideas and Innovations in Technology, (Volume 9, Issue 2 – V9I2-1331), : https://www.ijariit.com

Riyazahmed K. (2021). Investment motives and preferences – An empirical inquiry during COVID-19. Investment Management and Financial Innovations, 18(2), 1-11. doi:10.21511/imfi.18(2).2021.01

Targalski, J. (2006). Innowacyjność – przyczynaiskutekprzedsiębiorczości. ZeszytyNaukowe nr 730/2006, 1-5.

Tufano, P. (1995); ―Securities Innovation: A Historical and Functional Perspective, Journal of Applied Corporate Finance; 4 (Winter); 90-104.

Yuliia Shapoval (2021). Relationship between financial innovation, financial depth, and economic growth. Investment Management and Financial Innovations, 18 (4), 203-212. doi:10.21511/imfi.18(4).2021.18