Research Objectives:

This paper examines how resilience transcends the concept of merely bouncing back, encompassing the ability to adapt and grow stronger amidst change.

Keywords:

Resilience, Sustainability, Adaptation, Personal growth, Corporate accountability

Bio

Sharontine Bottley, eldest of four from a small town in North Louisiana, always felt destined for more. With a degree in Finance and Economics, she excelled in banking, finance, and federal sectors, continually raising her own bar. Despite personal trials, including a challenging divorce, homelessness, financial setbacks, and harrowing experiences like being kidnapped, she never lost sight of her vision. Sharontine is dedicated to empowering women who, like her, have faced profound adversity yet possess untapped brilliance and potential. Her mission is clear: to guide them beyond pain, helping each discover their purpose and realise their worth.

Abstract

In 2024, the integration of resilience and sustainability has become vital as organisations and governments address the pressing need to adapt to climate change while ensuring long-term viability. The focus has shifted toward the sustainability of resilience, emphasising the development of systems and strategies that can endure and recover from various shocks and stresses over time. A growing commitment to empowering individuals to thrive in a dynamic world underpins this transformative shift. As corporate sustainability transitions from an optional consideration to a critical business imperative—driven by regulatory pressures and consumer expectations—the importance of resilience has never been greater. This paper examines how resilience transcends the concept of merely bouncing back, encompassing the ability to adapt and grow stronger amidst change. A unique approach combining compassion with professional expertise in finance, economics, and personal development provides tailored support for individuals and organisations, enabling them not only to survive but also to excel.

In 2024, fostering resilience involves adapting to evolving conditions, leveraging technological advancements, and promoting cross-sector collaboration. This approach aims to create a more resilient and sustainable world capable of withstanding future challenges. By recognising and harnessing personal strengths and experiences, individuals can build a foundation of resilience through practical strategies for financial stability, emotional well-being, and personal growth. The overarching mission is to inspire a ripple effect of strength and positivity, enabling individuals and organisations to navigate uncertainties with confidence and to contribute to a legacy of resilience and success in an ever-changing environment.

-

Introduction

Resilience and sustainability are the hallmarks of twenty-first-century economies. The goal is that businesses and industries are sustainable, and the value chains are robust against abrupt changes internally and externally. Europe is entering a new period – it has been little more than a decade since the last institutional and funding program period started (Olsson, 2020). The three years between the start of this new decade and the halfway point to the SDGs of 2030 is an opportune moment to discuss and decide about the values, ambitions, landscapes, and approaches for this period. The challenges Europe and the world face are immense, and their consequences are utterly uncertain. Regions, economies, societies, and industries are in different phases of employment transformations, population change, and political decision-making, on their readiness for future changes and preparedness for more or less secure states of being.

This research article, seeks to understand what and where wealth is and how wealth maintenance becomes sustainable. It argues that resilience and sustainability go hand in hand. Long-term green growth depends on the way humanity values wealth and promotes its sustainability on various dimensions. As we acknowledge wealth and wealth-making, it is wealth maintenance and the face of resilience that represents the ultimate reference to defining wealth, for it is what we want to sustain in order that future generations have equivalent, equal, or improved options and opportunities on all life-sustaining fronts. Wealth maintenance that is resilient is equivalent to wealth that is sustainable. We thus aim this series of special issues to explore the face of wealth – the face of our human endeavours and means that promote wealth maintenance in order to sustain, evolve, and improve our human endeavours (Canizares et al., 2021). Our endeavours, when grounded, are interdependent and show interest in sustainability across many dimensions.

1.1. Overview of the Importance of Resilience and Sustainability in 2024

Resilience and sustainability are crucial in current environments due to the multitude of significant global challenges. Despite reopening due to the reduction of lockdown measures, a significant percentage of Australian small-to-medium business owners expect below-average economic performance. Whether on a macro or micro scale, resilience is the key to success during economic downturns and upswings (Calculli et al. 2021). Additionally, throughout the pandemic, a mass awakening about the health of the planet has gripped the international community, and environmental health is viewed as crucial. A large percentage of Australians are more aware of the impact of climate change on humanity as a result of the pandemic.

Resilience is dynamically linked to sustainability. Many income sources and economic realms are seeing major fluctuations, including jobs, shares, or property investments, increasing the importance of maintaining sustainable, low-harm operations. Our homes and cities are fundamentally intertwined with nature, with a single natural disaster profoundly affecting various sectors, including housing, supply chains, asset values, human health, and the environment. Destructive forces impacting the environment, human landscapes, and the economy are increasing and require second thoughts regarding sustainability. In capital cities, homelessness directly costs a significant amount per average homeless person; factors such as housing affect whole-of-system costs (Zhang et al.2022). Relocation from one city to another, if possible, further undermines long-term profitability. Parameters associated with an overreliance on the market without a Plan B are a slippery slope to decreasing personal or collective wealth.

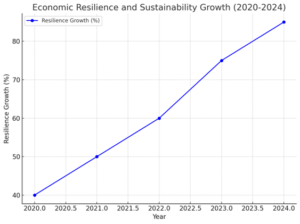

This graph in figure 1 illustrates the trend of economic resilience and sustainability initiatives from 2020 to 2024. The upward trajectory reflects the increasing focus on integrating resilience into sustainable development practices globally.

Figure 1 (Canizares, et al, 2021)

1.2. Definition of Resilience Beyond Recovery

When it comes to resilience, the 2022 update adds additional flesh to its bones from 2017. It has been important for us to begin to create a common language over what sustainable wealth is. However, as this has highlighted for individuals, as well as for businesses, government, or a place, there is no point in creating a set of systems that help us to recover from challenges when we could already be proactively planning for greater adaptability in future ways of living, working, and serving. Furthermore, resilience is not just for those that serve wealthy nations; it has emerged as a strategic personal and professional skill wherever you live and work (Hurley et al. 2020). Recovery is not just about folding up the tissues and forgetting. It is about absorbing the learning, resetting your course to the new place you have been able to stand, and beginning to let the light in and share reflections and corrections.

The following five key words to capture the flavour of the argument: people, process, training, health, resilience = adaptability. What did we learn about resilience in 2022? We slightly refined our understanding of how to look at it in our training for a number of small and large organizations. Across individuals, community, and organizational thinking, we often think of resilience as an individual static trait that some of us have and some of us do not. If resilience is in your DNA, you can bend like a blade of grass on a heavy day. However, increasingly we are observing that networked communities are those that tend to exhibit high levels of community resilience (Melendez et al.2022). They live lives where they will often be in need of extended family or neighbours, and accordingly, it is more likely than not that they will have developed strong, reciprocal social networks that will carry them through tough times. You can live your life proactively with a belief you are a resilient being because it is also a way of being as much as a separate thing that in some form can be taught and tested.

- Aim

There is a focus on empowerment in both individuals and organisations, in terms of emotional intelligence and expertise, without losing sight of the need for sustainable results. Even if compassion does not evoke empowerment off the bat, wisdom and expertise certainly do – knowledge is power. The question is whether states and large employers are capable of reaching a consensus that favours the empowerment of practitioners, professionals, and individuals who can round out knowledge with emotion (and vice versa), reinforcing it with compassion, so that sampling and decisions are more sustainable in the future. Indeed, experts are not infallible, and decision-making is more valid if it draws on a variety of angles and on a number of samplings. Sustainable decision-making within a diversity dialogue will thus be credible and will be able to lay the economic, social, or institutional groundwork for markets that are just and equitable. Just and equitable are our two key words; indeed, they speak to how important it is to enjoy psychological comfort. The more people’s dignity is recognized, the greater the opportunities that open up for them, and the same applies to states and large employers. It is in everyone’s interest to tip the balance towards individual empowerment. The equilibrium that results calls for long-term strategies that prioritise knowledge and development and espouse reciprocity and experience as capital assets. By drawing on the relationship between knowledge and the emotional intelligence of the individual and the collective, we hope to provide an orientation, to offer food for thought, and to suggest points of contact to which the reader can return when building his or her own strategies for sustainable provision.

2.1. Empowerment of Individuals and Organizations through Compassion and Expertise

Compassion tread the path of expertise, opening up new ways of seeing what is, and kick-starting the transformation that empowers through support. It is especially important, at these times of crisis, that we are nurtured in ways that help build our capacity to be resilient. Only then will we be able to ride the crest of the wave of collective transformation and not be sucked into the undertow of divisive self- and other making.

A move towards a supportive, caring society, citizenry, and world not only by our governments but by our organisations, families, relationships, and, critically, by ourselves. We increasingly envisage our leaders to be ’emotionally aware,’ but rare has been the time when those leaders have been truly embraced. That is because moving ahead is not that simple and requires the ability to see the truth and the willingness to walk the path of compassion that exists despite the overwhelming emotions tied up in the threat of change. This is a time, therefore, when those who know how to be resilient are among the most precious resources (Lombardi et al. 2021). Empowerment is created not just through incentives and accountability, but by the ways in which we support our future leaders to think critically, empower others, and embody themselves as compassion and expertise.

As new digital and cyber-physical technologies are being promoted (Surao, 2018), we need systems of knowledge-sharing and emotional resilience-building that are as accessible to our future leaders as social media and as perennially supportive as mentorship. Of course, the move towards a more holistic and inclusive attitude in recognising the impact of personal development on corporate patterns has been a number of years in the making. But the extent of the changes preferred will require a more large-scale embrace. Let us be clear that both individuals and organisations will benefit from the transformation of individuals: most ultimately, we all want to be part of a compassionate society where we grow and feel empowered and empower others in turn (Rapp and Corral-Granados, 2024). We need the vision and power of an angle of compassion combined with the trailblazing knowledge of expertise needed to make a world of change. In this way, we may not just expect the shape of a smiling face to stay the same, but we may expect a lot more individuals in a network of liberated changers to smile back at you.

-

Method

To embrace sustainable wealth and its main elements, both a qualitative and quantitative method grounded in finance, economics, and personal development has been taken. Searching for sustainable wealth, taking the possibilities offered by permanent portfolio theory into account, was embedded in a qualitative narrative literature analysis. Literature is scrutinised on a portfolio, economics, and financial planning, as well as positive psychology and emotional development, trying to gain a deep understanding of the background of possibilities for investors. In order to steer clear of the charge of cherry-picking or selection bias, the results of scan on the variability of keywords, which allowed for the publication of the paper in a top-tier double-blind journal.

It is a combination of both hemispheres in the human brain (analytical capacities limited to finance, economics, and personal development and the holistic, intuitive compatibility with connectedness to make a decision) in an attempt to investigate the possibility of recognising sustainable wealth as more than merely a financially outstanding status. The goal of searching for sustainable wealth is not out of the field for Luhmann, who also stated that “Autopoietic systems may exist in society.” Most certainly, systemic effects are influencing the operation and vulnerability of autopoiesis. This implies a potential to observe a person, segment culture, and branch economics and finance within these boundaries. The research method applies to the way the author had to behave to obtain sustainable wealth and follow the PPT constraints. It can support a cautious, value investing mindset or strategy. Any natural or semi-natural study needs a detailed description of the research method to justify the validity and credibility of the investigation. It was important for all authors to take the first steps out of cyclical asset allocation to see how a career stock analyst could do it (Lühmann & Vogelpohl, 2023).

3.1. Combining Finance, Economics, and Personal Development

The disciplines used in combination to analyse and approach the transient and decaying systematic influence on the sustainable accumulation of relations and assets are: * Finance, in order to understand the concept, function, logic, instruments, and strategies of wealth and investment management. * Economics, as a framework to delineate the organization and functioning of markets, market interaction, competitiveness, and product lifecycle. * Personal development, because decision-making, strategy creation and implementation, leadership, and thus change and transformation are about people and made by people. It is concluded that these three disciplines are not separate but interrelated. Another conclusion is that the countervailing trends of oversupply, mediocrity, blockchain, artificial intelligence, and importantly, renewal of human interaction during the shift of eras make it essential to take once again into account the key drivers of long-term strategic thinking and action in our research areas (Atmaja et al., 2022). A combined discipline is therefore suggested as a key differentiating factor in the evolutionary triptych of personal, business-organisational, and societal growth, both in the present era shift and in the eras that will follow. The suggested mesh between strategy and the five forces of the market equally illustrates the blending of different fields of expertise, such as economics, finance, and personal development into the wider framework of long-term growth.

-

Results and Discussion

There is a positive link between financial stability and emotional well-being. In the field of management, we have observed that recognising and maintaining good practices in organisations accumulates resources and contributes to stable life satisfaction over the long term. In sum, designing and using practices and organisational ethics that allow for the most resilient and cohesive responses to turbulent times will rejuvenate people over time, a practice that benefits both individuals and wider ecologies. Given that this may also lead to improved financial conditions or growth, it can generate sustainable wealth.

Findings here also show that desiring stable life satisfaction over time has less to do with paying attention to specific external metrics or whether we are in periods of growth or recession and more to do with two things: 1. a desire to further grow resources and contribute positively to ever broader ecosystems and 2. how the integration of a moral language and practice into organisations can provide resilience and the potential to adapt to turbulent times and be rejuvenate over time. Accordingly, the ability of individuals and society more widely to adapt to and flourish under changing environments has an emotional and an economic dimension.

4.1. Fostering Financial Stability and Emotional Well-being

Fostering financial stability brings about positive emotional states, including enhanced confidence, mental security, trust, and relational connections. Taken together, these combine to make individuals feel more capable and secure, reducing anxiety for themselves and members of their broader community. In this way, financially secure individuals are more likely to volunteer, feel that their community is supportive, and be more active during times of communal crisis, such as a natural disaster (Kim & Mason, 2020). This sense of harmony between the individual and society is not only good for community cohesion but also leads to better economic and other resource outcomes during a financial catastrophe.

At a personal level, the following techniques are understood to lead to perceived financial stability: having short-term and long-term financial plans; managing cash flow to ensure financial resilience; investing in appreciating assets; overcoming poverty and intergenerational social exclusion; means creation rather than poverty alleviation; fostering individual, household, and community resilience to prevent poverty; prevention through surveillance to circumvent catastrophes; the pursuit of happiness through activities that include hobbies; niche business development; early childhood intervention; mental health; and productive years (Ozili and Iorember, 2024). Thus, many strategies for creating financial stability are fundamentally sustainable approaches. Thinking about wealth, our financial well-being, our emotional well-being, and the balance between them is essential as we endeavour to build people-cantered prosperity together.

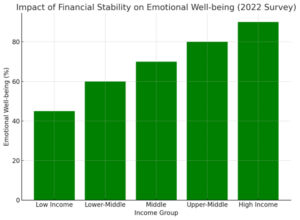

Figure 2 shows the correlation between financial stability and emotional well-being based on a 2022 survey. The data reveals a positive relationship between higher financial security and improved mental and emotional health.

Figure 2 (Kim & Mason, 2020)

Financial factors are an important but incomplete part of life. Our emotions influence our financial actions. A balance between different emotions leads to financial well-being for every person. Financial well-being is also psychologically related to active community engagement and effective long-term poverty alleviation. The question is how these effects can be optimally fostered in harmonious combination with policy development. To illustrate how different strategies produce different capacities and opportunities, we consider evidence from a case study. First, evidence shows that community development creates a range of opportunities, including tangible assets. Second, however, it is clear from the happiness data that active engagement in efficient and substantial community development also has an extensive range of psychosocial activities, and some staff and study participants are actively engaged in well-being-driven economic, poverty-reducing activities. Finally, many assets can develop together, reinforcing each other. This comprehensive strategy is vital to achieving sustainable prosperity (Sithole et al.2021).

-

Conclusion

In a context marked by widespread uncertainties, investing in sustainable wealth practices that support people’s ability to thrive and respond positively to crises becomes critical in shaping the lives we want to live in 2024. Core to sustainable wealth are the values of community and collaboration between abstract and embodied knowledge and actions. Agripharmatechture, the next economic growth trajectory, symbiotically combines agriculture, pharmaceuticals, and architecture in a holistic design that nourishes all bodies. By embracing circularity, it represents agility, flexibility, and resilience, which are values transferable to re-establish and maintain sustainable wealth practices through adverse times.

Recognising the importance of personal well-being and the quest for sustainable wealth, more often the conversation assumes an objective goal of profit. For the dis-embodied economic man, where the only relation that can exist is an exchange relation, it is difficult for individuals to re-embody and accrue physical, social, financial, inner and outer resources to support one’s well-being. It is why sustainable wealth through diversification and pursuing a multi-stakeholder approach beyond financial capital alone have proved insightful for key findings: 1. Sustainable wealth practice enhances economic, political and emotional resilience. 2. Diversifying over different kinds of wealth can empower. 3. Inner wealth supports the emotional experience of well-being. For well-being supporters, to manage personal wealth, it is first important to address the issues of power, politics and infrastructure. It is important that the policy supports individuals to engage proactively and act in an empowered way to shape the emotional experience of their own and society’s well-being. Practices of sustainable wealth-building could take place at the same time as efforts to build infrastructure and power, to enhance the health of the economy and local democratic capability overall. Further research in this area should strengthen the attention of ‘inner wealth’ practices, integrating approaches to support the community in steering and measuring the sustainability of well-being gains. Societies capable of this will support all members to ‘live the lives we want’ (Hariram et al., 2023).

5.1. Inspiring Confidence in Navigating Uncertainties

The uncertainty in the global economy has caused everyone to recalibrate strategies and to raise more questions than answers about macroeconomic outlooks, inflation rates, interconnected supply chain disruptions, and global central bank stances, right through to the psychology of consumers, employees, and investors. FOMO, for example, is nothing new and is part and parcel of any investment cycle, encouraging passive or leveraged forms of investment. The challenge for long-term wealth managers, then, is getting more people to believe in themselves, to invest confidence in themselves and their judgment, to trust in their intelligence and experience, and to take some risks regarding their capabilities. Uncertainties expose emotional vulnerabilities that the wealth management industry has to address, particularly in educating clients on what is normal. As a consequence, nurturing resilience in this difficult investment environment is not just a useful coping skill, but the most fundamental life skill. Processes for cultivating resilience have been tested throughout time and have been recorded in every culture. They are processes that develop a growth mindset, flexible thinking, and hearty reflexes to mistakes, failures, setbacks, and vulnerabilities. Failure and learning are simply not enough for sustainable wealth – as an even more powerful emotional muscle than seeking perfection and avoiding risks, adversity not only teaches us resilience, but it also instils energy and enthusiasm in the human spirit. At extreme events like the international disputes causing havoc in markets or the move towards open social discussions about mental health, there is potential in embracing this adversity. For financial planners, deepening a client’s resilience in an era of uncertainty leads to even greater stamina, vitality, reinvention, and lifelong giving and learning to others. (Bhatt et al.2023)

References:

Atmaja, D. S., Fachrurazi, F., Abdullah, A., Fauziah, F., Zaroni, A. N., & Yusuf, M. (2022). Actualization of performance management models for the development of human resources quality, economic potential, and financial governance policy in Indonesia ministry of education. iainptk.ac.id.

Bhatt, B., Qureshi, I., Shukla, D. M., & Pillai, V. (2023). Nurturing resilient communities: An overview. Social Entrepreneurship and Gandhian Thoughts in the Post-COVID World, 1-25. researchgate.net.

Calculli, C., D’Uggento, A. M., Labarile, A., & Ribecco, N. (2021). Evaluating people’s awareness about climate changes and environmental issues: A case study. Journal of Cleaner Production, 324, 129244. [HTML].

Canizares, J. C., Copeland, S. M., & Doorn, N. (2021). Making sense of resilience. Sustainability. mdpi.com.

Hariram, N. P., Mekha, K. B., Suganthan, V., & Sudhakar, K. (2023). Sustainalism: An integrated socio-economic-environmental model to address sustainable development and sustainability. Sustainability. mdpi.com.

Hurley, J., Hutchinson, M., Kozlowski, D., Gadd, M., & Van Vorst, S. (2020). Emotional intelligence as a mechanism to build resilience and non‐technical skills in undergraduate nurses undertaking clinical placement. International Journal of Mental Health Nursing, 29(1), 47-55. [HTML].

Kim, M., & Mason, D. P. (2020). Are you ready: Financial management, operating reserves, and the immediate impact of COVID-19 on nonprofits. Nonprofit and Voluntary Sector Quarterly. sagepub.com.

Lombardi, S., e Cunha, M. P., & Giustiniano, L. (2021). Improvising resilience: The unfolding of resilient leadership in COVID-19 times. International Journal of Hospitality Management, 95, 102904. nih.gov.

Lühmann, M., & Vogelpohl, T. (2023). The bioeconomy in Germany: A failing political project?. Ecological Economics. sciencedirect.com.

Melendez, A., Caballero-Russi, D., Gutierrez Soto, M., & Giraldo, L. F. (2022). Computational models of community resilience. Natural Hazards, 111(2), 1121-1152. [HTML].

Olsson, D. (2020). The transformative potential of resilience thinking: How it could transform unsustainable economic rationalities. Alternatives. sagepub.com.

Ozili, P. K., & Iorember, P. T. (2024). Financial stability and sustainable development. International Journal of Finance & Economics, 29(3), 2620-2646. uni-muenchen.de.

Rapp, A. C., & Corral-Granados, A. (2024). Understanding inclusive education–a theoretical contribution from system theory and the constructionist perspective. International Journal of Inclusive Education, 28(4), 423-439. tandfonline.com.

Sithole, N., Sullivan Mort, G., & D’Souza, C. (2021). Financial well-being of customer-to-customer co-creation experience: a comparative qualitative focus group study of savings/credit groups. International Journal of Bank Marketing, 39(3), 381-401. [HTML].

Surao, A. (2018). Design and Implementation of Plc Based Robot Control of Electric Vehicle. Mathematical Statistician and Engineering Applications, 67(1), 33–43.

Zhang, L., Xu, M., Chen, H., Li, Y., & Chen, S. (2022). Globalization, green economy and environmental challenges: state of the art review for practical implications. Frontiers in Environmental Science, 10, 870271. frontiersin.org.